Cryptocurrency or crypto : Ethereum (ETH) coin Definition,Why Ethereum ,History of ETH, Founder,Owner, CEO, ETH Market Rank,Security,Market cap,Roadmap,Market Circulation,DeFi

Cryptocurrency or crypto : Ethereum (ETH) coin Definition,Why Ethereum ,History of ETH, Founder,Owner, CEO, ETH Market Rank,Security,Market cap,Roadmap,Market Circulation

What Is Ethereum (ETH)?

|

| Image logo of Ethereum (ETH) coin |

Ethereum is open access to digital money and data-friendly services for everyone – no matter your background or location. It's a community-built technology behind the cryptocurrency ether (ETH) and thousands of applications you can use today.

Ethereum is a decentralized open-source blockchain system that features its own cryptocurrency, Ether. ETH works as a platform for numerous other cryptocurrencies, as well as for the execution of decentralized smart contracts.

Ethereum was first described in a 2013 whitepaper by Vitalik Buterin. Buterin, along with other co-founders, secured funding for the project in an online public crowd sale in the summer of 2014 and officially launched the blockchain on July 30, 2015.

Ethereum’s own purported goal is to become a global platform for decentralized applications, allowing users from all over the world to write and run software that is resistant to censorship, downtime and fraud.

History of Ethereum (ETH) coin

The concept of decentralized digital currency, as well as alternative applications like property registries, has been around for decades.

The anonymous e-cash protocols of the 1980s and the 1990s, mostly reliant on a cryptographic primitive known as Chaumian blinding, provided a currency with a high degree of privacy, but the protocols largely failed to gain traction because of their reliance on a centralized intermediary.

In 1998, Wei Dai's b-money became the first proposal to introduce the idea of creating money through solving computational puzzles as well as decentralized consensus, but the proposal was scant on details as to how decentralized consensus could actually be implemented.

In 2005, Hal Finney introduced a concept of reusable proofs of work, a system which uses ideas from b-money together with Adam Back's computationally difficult Hashcash puzzles to create a concept for a cryptocurrency, but once again fell short of the ideal by relying on trusted computing as a backend.

In 2009, a decentralized currency was for the first time implemented in practice by Satoshi Nakamoto, combining established primitives for managing ownership through public key cryptography with a consensus algorithm for keeping track of who owns coins, known as "proof of work".

The mechanism behind proof of work was a breakthrough in the space because it simultaneously solved two problems.

First, it provided a simple and moderately effective consensus algorithm, allowing nodes in the network to collectively agree on a set of canonical updates to the state of the Bitcoin ledger.

Second, it provided a mechanism for allowing free entry into the consensus process, solving the political problem of deciding who gets to influence the consensus, while simultaneously preventing sybil attacks.

It does this by substituting a formal barrier to participation, such as the requirement to be registered as a unique entity on a particular list, with an economic barrier - the weight of a single node in the consensus voting process is directly proportional to the computing power that the node brings.

Since then, an alternative approach has been proposed called proof of stake, calculating the weight of a node as being proportional to its currency holdings and not computational resources;

the discussion of the relative merits of the two approaches is beyond the scope of this paper but it should be noted that both approaches can be used to serve as the backbone of a cryptocurrency.

Related Pages:

Read more about Ethereum ETH

Find out more about Solana SOL

Learn more about SHIBA INU

Find out more about Cardano ADA

Learn more about Litecoin LTC

Find out more about Internet Computer ICP

Who Are the Founders of Ethereum?

Ethereum has a total of eight co-founders — an unusually large number for a crypto project. They first met on June 7, 2014, in Zug, Switzerland.

Russian-Canadian Vitalik Buterin is perhaps the best known of the bunch. He authored the original white paper that first described Ethereum in 2013 and still works on improving the platform to this day.

Prior to ETH, Buterin co-founded and wrote for the Bitcoin Magazine news website.

British programmer Gavin Wood is arguably the second most important co-founder of ETH, as he coded the first technical implementation of Ethereum in the C++ programming language, proposed Ethereum’s native programming language Solidity and was the first chief technology officer of the Ethereum Foundation.

Before Ethereum, Wood was a research scientist at Microsoft. Afterward, he moved on to establish the Web3 Foundation.

Among the other co-founders of Ethereum are:

- Anthony Di Iorio, who underwrote the project during its early stage of development.

- Charles Hoskinson, who played the principal role in establishing the Swiss-based Ethereum Foundation and its legal framework.

- Mihai Alisie, who provided assistance in establishing the Ethereum Foundation.

- Joseph Lubin, a Canadian entrepreneur, who, like Di Iorio, has helped fund Ethereum during its early days, and later founded an incubator for startups based on ETH called ConsenSys.

- Amir Chetrit, who helped co-found Ethereum but stepped away from it early into the development.

Market rank of Ethereum (ETH) coin

Current Market Rank of Ethereum (ETH) coin is in Top 2

Market cap of Ethereum (ETH) coin

Current valuation or Market cap is nearly 462 Billion USD

What Makes Ethereum Unique?

Ethereum has pioneered the concept of a blockchain smart contract platform.

Smart contracts are computer programs that automatically execute the actions necessary to fulfill an agreement between several parties on the internet.

They were designed to reduce the need for trusted intermediates between contractors, thus reducing transaction costs while also increasing transaction reliability.

Ethereum’s principal innovation was designing a platform that allowed it to execute smart contracts using the blockchain, which further reinforces the already existing benefits of smart contract technology.

Ethereum’s blockchain was designed, according to co-founder Gavin Wood, as a sort of “one computer for the entire planet,”

theoretically able to make any program more robust, censorship-resistant and less prone to fraud by running it on a globally distributed network of public nodes.

In addition to smart contracts, Ethereum’s blockchain is able to host other cryptocurrencies, called “tokens,” through the use of its ERC-20 compatibility standard.

In fact, this has been the most common use for the ETH platform so far: to date, more than 280,000 ERC-20-compliant tokens have been launched.

Over 40 of these make the top-100 cryptocurrencies by market capitalization, for example, USDT, LINK and BNB. Since the emergence of Play2Earn games,

there has been a substantial increase in interest in the ETH to PHP price.

How much Ethereum (ETH) Coins Are There In Circulation?

In August 2020, there were around 112 million ETH coins in circulation, 72 million of which were issued in the genesis block — the first ever block on the Ethereum blockchain.

Of these 72 million, 60 million were allocated to the initial contributors to the 2014 crowd sale that funded the project, and 12 million were given to the development fund.

The remaining amount has been issued in the form of block rewards to the miners on the Ethereum network. The original reward in 2015 was 5 ETH per block, which later went down to 3 ETH in late 2017 and then to 2 ETH in early 2019.

The average time it takes to mine an Ethereum block is around 13-15 seconds.

One of the major differences between Bitcoin and Ethereum economics is that the latter is not deflationary, i.e. its total supply is not limited.

Ethereum’s developers justify this by not wanting to have a “fixed security budget” for the network.

Being able to adjust ETH’s issuance rate via consensus allows the network to maintain the minimum issuance needed for adequate security.

How Is the Ethereum Network Secured?

As of August 2020, Ethereum is secured via the Ethash proof-of-work algorithm, belonging to the Keccak family of hash functions.

There are plans, however, to transition the network to a proof-of-stake algorithm tied to the major Ethereum 2.0 update, which launched in late 2020.

After the Ethereum 2.0 Beacon Chain (Phase 0) went live in the beginning of December 2020, it became possible to begin staking on the Ethereum 2.0 network.

An Ethereum stake is when you deposit ETH (acting as a validator) on Ethereum 2.0 by sending it to a deposit contract, basically acting as a miner and thus securing the network.

At the time of writing in mid-December 2020, the Ethereum stake price, or the amount of money earned daily by Ethereum validators, is about 0.00403 ETH a day, or $2.36.

This number will change as the network develops and the amount of stakers (validators) increase.

Ethereum staking rewards are determined by a distribution curve (the participation and average percent of stakers): some ETH 2.0 staking rewards are at 20% for early stakers, but will be lowered to end up between 7% and 4.5% annually.

The minimum requirements for an Ethereum stake are 32 ETH. If you decide to stake in Ethereum 2.0,

it means that your Ethereum stake will be locked up on the network for months, if not years, in the future until the

Ethereum 2.0 upgrade is completed.

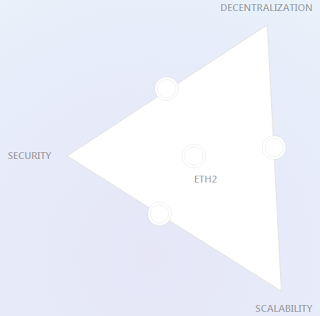

Understanding the Eth2 vision

Scalability 🚀

Ethereum needs to be able to handle more transactions per second without increasing the size of the nodes in the network. Nodes are vital network participants who store and run the blockchain.

Increasing node size isn't practical because only those with powerful and expensive computers could do it.

To scale, Ethereum needs more transactions per second, coupled with more nodes. More nodes means more security.

The shard chains upgrade will spread the load of the network into 64 new chains.

This will give Ethereum room to breathe by reducing congestion and improving speeds beyond the current 15-45 transactions per second limit.

More on shard chains

And even though there will be more chains, this will actually require less work from validators - the maintainers of the network.

Validators will only need to 'run' their shard and not the entire Ethereum chain. This makes nodes more lightweight, allowing Ethereum to scale and remain decentralized.

Security 🛡️

The Eth2 upgrades improve Ethereum's security against coordinated attacks, like a 51% attack.

This is a type of attack where if someone controls the majority of the network they can force through fraudulent changes.

The transition to proof-of-stake means that the Ethereum protocol has greater disincentives against attack.

This is because in proof-of-stake, the validators who secure the network must stake significant amounts of ETH into the protocol.

If they try and attack the network, the protocol can automatically destroy their ETH. More on proof of stake

This isn't possible in proof-of-work, where the best a protocol can do is force entities who secure the network (the miners) to lose mining rewards they would have otherwise earned.

To achieve the equivalent effect in proof-of-work, the protocol would have to be able to destroy all of a miner's equipment if they try and cheat. More on proof of work

Ethereum's security model also needs to change because of the introduction of shard chains.

The Beacon Chain will randomly assign validators to different shards - this makes it virtually impossible for validators to ever collude by attacking a specific shard.

Sharding isn't as secure on a proof-of-work blockchain, because miners can't be controlled by the protocol in this way.

Staking also means you don’t need to invest in elite hardware to 'run' an Ethereum node.

This should encourage more people to become a validator, increasing the network’s decentralization and decreasing the attack surface area. More on nodes

Sustainability

Ethereum needs to be greener.

It's no secret that Ethereum and other blockchains like Bitcoin are energy intensive because of mining. More on mining

But Ethereum is moving towards being secured by ETH, not computing power – via staking. More on staking

Although staking will be introduced by the Beacon Chain, the Ethereum we use today will run in parallel for a period of time, before it 'merges' with the Eth2 upgrades.

One system secured by ETH, the other by computing power. This is because, at first, shard chains won't be able to handle things like our accounts or dapps.

So we can't just forget about mining and Mainnet.

With the Beacon Chain up and running, work has begun on merging Mainnet with the new system.

This will turn Mainnet into a shard so that it’s secured by ETH and far less energy intensive.

What's DeFi?

DeFi is a collective term for financial products and services that are accessible to anyone who can use Ethereum – anyone with an internet connection.

With DeFi, the markets are always open and there are no centralized authorities who can block payments or deny you access to anything.

Services that were previously slow and at risk of human error are automatic and safer now that they're handled by code that anyone can inspect and scrutinize.

There's a booming crypto economy out there, where you can lend, borrow, long/short, earn interest, and more.

Crypto-savvy Argentinians have used DeFi to escape crippling inflation.

Companies have started streaming their employees their wages in real time.

Some folks have even taken out and paid off loans worth millions of dollars without the need for any personal identification.

Learn Defi from Video

DeFi vs traditional finance

>> One of the best ways to see the potential of DeFi is to understand the problems that exist today.

>>Some people aren't granted access to set up a bank account or use financial services.

>>Lack of access to financial services can prevent people from being employable.

>>Financial services can block you from getting paid.

>>A hidden charge of financial services is your personal data.

>>Governments and centralized institutions can close down markets at will.

>>Trading hours often limited to business hours of specific time zone.

>>Money transfers can take days due to internal human processes.

>>There's a premium to financial services because intermediary institutions need their cut.

Reference of this Information

Ethereum(ETH) official website